Private vs Public: A Tale of Two B.C. Job Markets

Recent employment trends in B.C. reveal a growing divide between types of employment. One of the clearest signs is where jobs are (and aren’t) being created. Job growth is heavily skewed toward the public sector, while private sector hiring has fallen well below historical norms.

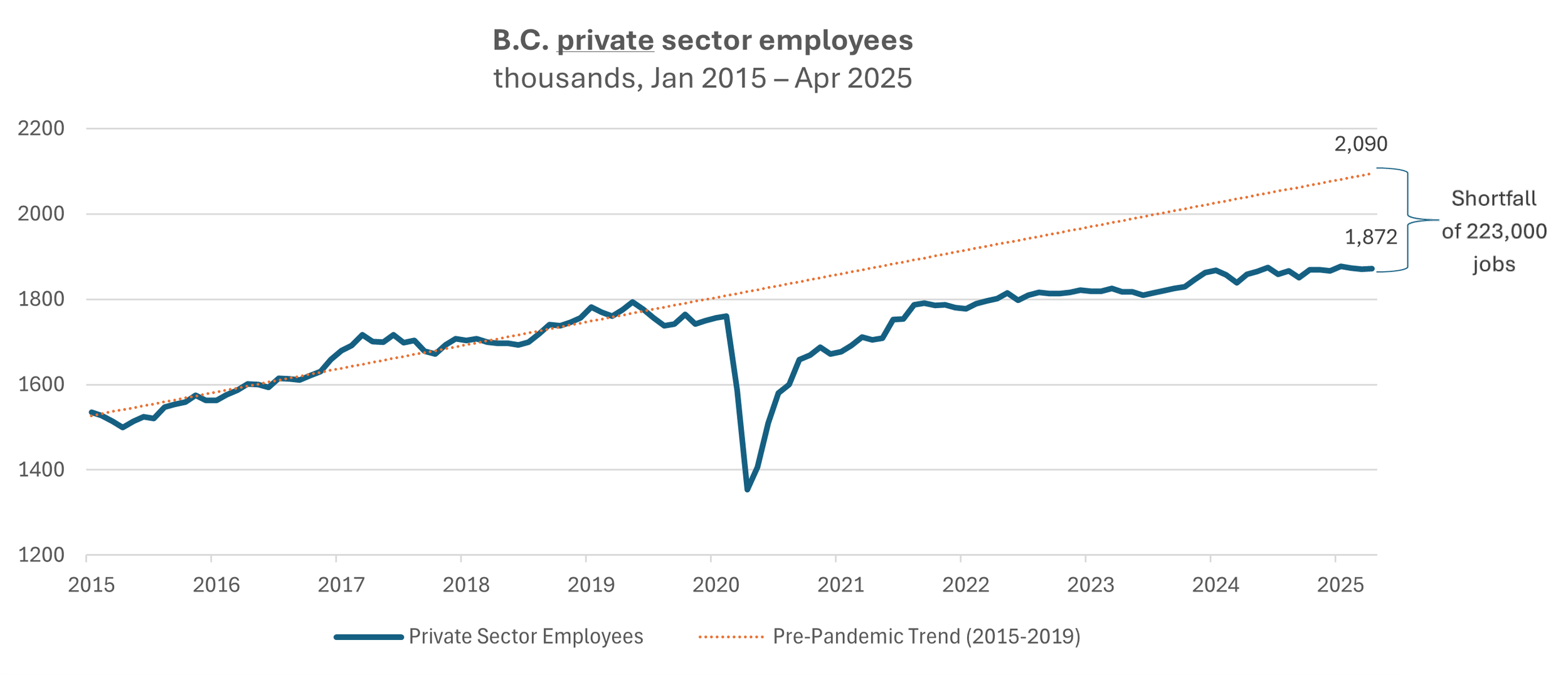

Had the private sector continued growing at its pre-pandemic pace, B.C. would have around 2.1 million people working in private sector jobs today. Instead, the number is around 1.9 million — a shortfall of 223,000 jobs (Figure 1). In contrast, the public sector has expanded strongly. If the sector had followed its pre-COVID trajectory, B.C. would have roughly 477,000 public sector jobs today. Instead, it has 612,000 — 134,000 above its pre-pandemic trajectory (Figure 2).

Figure 1: Private sector hiring well below pre-pandemic trend

Source: Statistics Canada. Table 14-10-0288-01 Employment by class of worker, monthly, seasonally adjusted.

Figure 2: Public sector hiring well above pre-pandemic trend

Source: Statistics Canada. Table 14-10-0288-01 Employment by class of worker, monthly, seasonallly adjusted.

The divergence between private and public sector employment since 2019 has been significant. Over the long term (1976 to 2024), B.C.’s private sector jobs grew at a compound annual growth rate of 2.1%. Since 2019, that’s dropped to just 1.1% per year, which is the largest deviation from historical growth rates among the provinces (Figure 3). In fact, B.C. ranks third lowest for private sector job growth since 2019, ahead of only Quebec and Newfoundland and Labrador. But no other province has seen such a sharp slowdown relative to its own long-run average. This signals a private labour market that is struggling not just in absolute terms, but in historical context.

Figure 3: B.C.’s private sector job growth has slowed more than in any other province relative to historical averages

Source: Statistics Canada. Table 14-10-0027-01 Employment by class of worker, annual (x 1,000).

The contrast with the public sector is stark. From 1976 to 2024, public sector jobs in B.C. grew at a compound annual growth rate of 1.9% per year. Since 2019, that rate has increased to 5.4% — nearly triple the historical pace (Figure 4). That’s the third-highest divergence among all provinces, trailing only New Brunswick and Prince Edward Island. And in terms of overall growth, B.C. has seen the second-highest increase in public sector jobs since 2019. Put simply: over the last five years, B.C. has seen a weak private sector job market alongside a strong public sector job market.

Figure 4: Over the last five years, public sector job growth in B.C. has accelerated neary three times its historical pace

Source: Statistics Canada. Table 14-10-0027-01 Employment by class of worker, annual (x 1,000).

It’s important to note that public sector jobs include those in public administration, health care and social assistance, and educational services, which are sectors that typically grow with population and service demand. But in recent years, growth has accelerated well beyond historical norms.

Between 2019 and 2024, employment growth in all three major public sector sub-sectors far exceeded their historical averages. Public administration grew the most compared to its historical trend, rising at nearly three times its long-term (1987-2024) growth rate. Public sector health care and education jobs grew at more than double (2.3 times) their typical pace over the last five years. (Figure 5).

Figure 5: Since 2019, all major public sector subsectors have outpaced their historical growth — but public administration saw the biggest surge

Source: Statistics Canada. Table 14-10-0027-01 Employment by class of worker, annual (x 1,000).

Conclusion

B.C.’s labour market is not creating enough jobs to absorb the province’s population growth (see B.C.’s lagging job creation indicates a weakening economy). Moreover, job creation has been concentrated in the public sector and not the private sector. The weakness in private sector job creation is important because ultimately it provides the income growth and tax base to fund the public sector. Unless private sector hiring improves, the province’s fiscal pressures could become more acute